Location: Home >> Detail

TOTAL VIEWS

J Sustain Res. 2020;2(4):e200037. https://doi.org/10.20900/jsr20200037

1 Singapore Management University, 178899, Singapore; Email: davidding@smu.edu.sg

2 Massey University, Auckland, 0745, New Zealand; Email: d.ding@massey.ac.nz

This article belongs to the Virtual Special Issue "Corporate Sustainability"

The purpose of this paper is to investigate the effect of corporate green announcements on the stock performance of listed companies in New Zealand. We find that the market has a positive, though not significant, reaction to the announcements. New Zealand companies are largely viewed to be already quite green at the onset and the market is not very much surprised by such announcements but expect them to continue being green. Our results are consistent with the view that to be green is costly, especially so in a developed economy where the cost of doing business is high. Our findings underscore the importance for corporate managers in New Zealand that, while any positive green announcements that they make might not have a significant market reaction, they are nonetheless positive.

In 2015, the United Nations outlined 17 sustainable development goals for adoption by all member nations by 2030. According to the UN, corporate social responsibility (CSR) is a management concept whereby companies integrate social and environmental concerns in their business operations and interactions with their stakeholders. The goal is to achieve a balance of economic, environmental and social imperatives, while at the same time addressing the expectations of shareholders and stakeholders. To this end, companies in New Zealand had already begun to consider programs that promote clean and efficient renewable energy. The UN’s 7th sustainable development goal is to promote affordable and clean energy—energy that is more sustainable and widely available.

With an increasing awareness of environmental problems in society, consumers and investors demand companies to take more social responsibilities for their business (Kruger, 2011 [1]). Under such external pressure, firms have to think about whether it is worth paying extra cost to go green. The debate of “is it worth being green” has been argued many times. Some may still consider that going green is costly and will be harmful to firms’ profit. For example, solar products may be more expensive than traditional products with similar functions. However, it is difficult to measure the cost of going green by the exact dollar amounts spent. The benefits could be found in many different areas and sustainable in the long term. A simple example in our daily lives is, an energy saving light bulb may cost a little bit more than a normal one, but it could save more energy cost and thus provide savings in power bills for the long term (Green Experience, 2011 [2]). Fortunately, many countries have realized the increasing importance of the environmental issue. Both the government and the public have been paying greater attention on environmental protection and the reduction of harmful effects on the environment (UNIDO, 2010 [3]). But how does the investing public, particularly share investors, view and react to such initiatives?

There are a several perspectives for companies’ green activities. Some may believe it can improve the efficiency in operating and increase corporate reputation which could generate more benefits, while others may consider expenditures on the environment as a burden that would decrease companies’ competitive advantage (Hart & Ahuja, 1996 [4]). In most situations, companies’ green activities cost money directly and reduce revenues simultaneously, which may lead to a decrease in future cash flows. As the stock price is based on future cash flows, investors may worry about the negative impact on the stock price. However, even though the cash flow per unit may decrease, consumers generally welcome corporate green behavior and are more likely to buy green products as they may not mind paying a little more for them. Thus, it is expected that total sales revenues would increase to the extent that it could more than cover the extra costs of going green.

This paper studies the effects of environmental components on companies’ equity value through the testing of stocks’ abnormal returns from green announcements. The insights drawn from the present study are particularly enlightening for a small but developed economy such as New Zealand, as prior studies are centered mostly on much larger economies such as the USA or Australia. It is particularly interesting to study New Zealand as Kumar and Khanna (2009 [5]) find that it is one of only three countries (together with Ireland and Luxembourg) that ranked in the highest tier group with an environmentally binding production technology. Their study of the environmental efficiency and productivity of 38 countries considers the reduction of each country’s carbon emission.

The definition of “green” within this study is not simply the substitution for things that are “environmental.” It includes any issues that have a health effect on living things (Richmond, 2007 [6]). In our daily lives, everyone can go green easily. For example, driving less or using public transportation more regularly can reduce the carbon emission which is harmful to humans and the global environment. Ding, Ferreira, and Wongchoti (2016 [7]) show that the value impact of corporate social responsibility (CSR) activities (including environmental issues) relies heavily on the industry-specific relative position of the firm. Only firms that distinguish themselves over their peers are associated with increased firm value. Their finding is robust and holds for both responsible and irresponsible behaviors.

What is a green announcement? This paper defines green announcements as those that are announced officially by company’s CEO or top executive. It includes:

1.

2.

3.

4.

5.

New Zealand is one of most eco-friendly countries in the world (Kumar & Khanna, 2009 [5]) where its residents have a strong environmental consciousness. This consciousness would be reflected by their stock market reaction to specific events of green announcements made by listed companies on the New Zealand Stock Exchange (NZX). We therefore examine the impact of green announcements on the companies’ stock performance.

The remainder of this article is organized as follows. Section “LITERATURE REVIEW AND HYPOTHESES” provides a review of the relevant literature and develops the hypotheses. Section “DATA AND METHODOLOGY” describes the sample data and the event study methodology. Section “RESULTS AND DISCUSSIONS” presents the results and discusses the findings and their implications. The last section concludes.

The corporate perspectives on environmental responsibility have achieved great progress over the last half a century. Hoffman (2000 [8]) defines four different historical stages of corporate environmentalism development: (1) Industrial environmentalism (1960–1970); (2) Regulatory environmentalism (1971–1981); (3) Environmentalism as social responsibility (1982–1989); and (4) Strategic environmentalism (1989–1999). In the first stage, the environmental management cost almost equals the pollution control management cost and is only a small portion of the total cost. In the second stage, the Environmental Protection Agency (EPA) plays the role of a regulator. In the third stage, the industry takes on a more important role as an environmental and social responsibility regulator and supervisor. The positions of companies’ environmental management are enhanced in the overall management structure. In the final stage, the environmental pressure not only comes from society and the government, other stakeholders such as investors and competitors become concerned as well. Today, environmental management has become increasingly important within corporations.

A survey by Nation’s Business (1993 [9]) documents that 86% of readers believe firmly the importance of ethics for a company’s financial performance, 11% consider there are more or less important and only 3% doubt the importance of ethics to financial performance. The survey results imply that the public requires firms to behave ethically and that unethical behavior would be costly to the firm. In fact, many companies do not consider “green issues” as cost terms. Excellent pollution control and prevention tend to conserve installation and operating costs; it also leads to a more efficient production process (Young, 1991; Schmidheiny, 1992 [10,11]). However, it is complex to explain whether the financial performance of companies is influenced by ethical or unethical behavior (Wood, 1994 [12]). Within the firm, production and process efficiency can be influenced by the ethical or unethical behavior of managers and employees (Sen, 1993; Hamilton, 1995; Hamilton & Strutton, 1994 [13–15]). Externally, stakeholders such as customers, suppliers, and debt holders could impact companies’ financial performance as well.

Previous studies have investigated the effect of companies’ environmental performance on their financial performance, especially in the US market. Many studies show that there is a relationship between environmental announcements and market reactions in different ways. Jacobs, Singhal, and Subramanian (2010 [16]) classify two categories of announcements: (1) Corporate Environmental Initiatives (CEIs), which are self-reported announcements about companies’ environmental performance, and (2) announcements of Environmental Awards and Certifications (EACs), which are events of achieving specific environmental awards or certifications. They conclude that both types of announcements do not have a significant effect on the market value of firms. However, they find that the market positively reacts to the announcements of environmental philanthropic gifts and ISO 14001 certification attainments, but negatively reacts to the announcements of voluntary emission reductions in the U.S. Their work shows that different types of announcements may lead to different market reactions and that announcements which are friendly to the environment do not necessarily lead to better financial performance of the firms.

Recent work by Ramiah et al. (2016 [17]) find that announcements of green policies result in cumulative abnormal returns of between 30% to 40% in certain sectors of the UK market and conclude that environmental policies induce changes in the systematic risk of businesses, both in the short run and the long run. Hart and Ahuja (1996 [4]) focus on the relation between emission reduction and corporate performance in the US market. Emission reduction is an important activity of going green. They indicate that efforts to prevent pollution and reduce emissions drop to the ‘bottom line’ within one to two years of their initiation and firms with the highest emission levels have the most to gain (Hart & Ahuja, 1996 [4]). They suggest that return on sales (ROS) and return on assets (ROA) have a direct positive impact, but that return on equity (ROE) has a lagged effect. Although we do not test the ROE, ROS or ROA effect in this article, we consider the time lagged effect of green announcements on stock prices. The lagged effect that we investigate refers to a possible delay in the stock market’s reaction to a green announcement.

Ahmadi and Bouri (2017 [18]) study the largest 40 companies in France to show that the quality of environmental disclosure is positively associated to environmental performance. Shin et al. (2018 [19]) assess the association between renewable energy utilization and firm financial performance among large US firms. They find that the top renewable energy user firms consistently generate superior financial performance compared to their industry peers.

A positive environmental performance of firms does not necessarily imply higher stock returns. Rao (1996 [20]) suggests a punishment on the market value of companies with a negative environmental performance. He selects 14 firms and uses monthly data to test the relationship between stock prices and unethical behaviors on the environment. He finds that stocks have negative abnormal returns around the announcement date of unethical behaviors. He suggests that companies with unethical behaviors that are concerning to the environment and have been reported publicly about it have lower returns than the market average.

Griffin and Sun (2013 [21]) study voluntary CSR disclosure in the context of climate change and find that managers’ disclosure decisions involving greenhouse gas emissions produce positive returns to shareholders. Earlier, Karpoff, Lott, and Wehrly (2005 [22]) examine the penalties imposed on companies that violate environmental regulations. They report that firms that violate environmental laws suffer significant losses in their equity value.

Nishant, Teo, and Goh (2017 [23]) investigate shareholder reaction to green information technology (IT) announcements. They find that IT announcements that address environmental issue generate positive abnormal returns and increase share trading volume. However, they also report that shareholders react negatively to announcements regarding sustainable products and services. They conclude that their results help explain how firm characteristics and different types of green IT announcements impact market value. These have significant implications for how firms plan and allocate their resources to support green initiatives.

While the general expectation is that corporate actions which are beneficial to the environment will improve companies’ financial performance, some empirical studies present inconsistent results (Corbett & Klassen, 2006 [24]). Jacobs et al. (2010 [16]) explain that these may be caused by a small sample size, controversial methodologies used or insufficient measures of companies’ environmental or financial performance. Others, however, view that to be green is costly and time and uncertainty may affect a firm’s inclusion in a study sample (Engardio et al., 2007 [25]). Friedman (1970 [26]) suggests that the extra cost of environmental improvements beyond legal requirements may be inconsistent with the objective of maximizing shareholders’ wealth and would hurt companies’ market value. On the other hand, Barnett and Salomon (2006 [27]) believe that companies with a high level of corporate social responsibility will attract more opportunities in the market and appeal to higher quality human resources. It is also possible that the market does not react on such announcements.

Gilley et al. (2000 [28]) do not find an overall effect on stock prices in regard to green initiatives in their full sample. However, when they divide the events into two different types (process-driven environmental initiatives and product-driven environmental initiatives), they find that product-driven ones have a stronger positive effect on stock prices than process-driven ones. Similarly, Videen (2010 [29]) tests the impact of both positive and negative announcements on listed companies from the Dow Jones Industrial Average. Putting all the announcements in a pool, he does not find that the events have any significant effect on the stock price. Moreover, after separating the announcements into positive and negative ones, he still finds no difference in the results of the positive and negative announcements. However, Filbeck & Gorman (2004 [30]) focus on some specific types of announcements. They find that announcements such as a company’s achievement of environmental awards have a significant impact on the stock price.

It appears that the market reacts differently to different types of companies and announcements. According to Jacobs et al. (2010 [16]), the stock market is expected to have a greater reaction to a smaller company’s announcements compared with larger ones; companies publishing announcements regularly are expected to have less impact than those that publish less frequently; green announcements from companies with a higher environmental reputation have a smaller effect on the market. Rao (1996 [20]) uses the efficient market hypothesis to study the effect of published reports of environmental pollution on stock prices. He concludes that the market is efficient based on its reaction to such public announcements.

Based on the mixed findings of previous studies, this article investigates the following hypotheses:

Hypothesis 1: Green announcements have no effect on companies’ stock returns.

Hypothesis 2: Green announcements have positive effects on companies’ stock returns.

Hypothesis 3: Green announcements have negative effects on companies’ stock returns.

We search for the dates of green announcements made by companies listed on the New Zealand Stock Exchange (NZX) main board based on the following selection criteria (It is acknowledged that our method of sample selection may introduce potential sample selection bias such as under-coverage of the population, voluntary response bias, and non-response bias. However, we believe that these biases are minimal as most CEOs can be assumed to be reasonable persons that would view green announcements as something positive and not hold back on their reporting):

1.

2.

3.

The announcements are searched on the Newztext Plus article database, which covers newspapers, magazines, radio transcripts, and Newzindex (includes articles from many New Zealand news, business, and industry magazines such as FairFax, NZ Herald, Stuff) from 1980 to 2012. Some of the announcements are obtained from the companies’ official websites. Following Jacobs et al. (2010 [16]), we use the following key words: Environment OR environmental OR green OR greener OR greenest OR greening OR greened OR emission OR carbon OR eco-friendly OR eco OR ecosystem OR ecological OR recycle OR recycles OR recycling OR energy OR reuse OR renewable OR waste OR pollution OR sustainable OR conserve OR conservation OR conservational OR resource OR social responsibility.

Green announcements selected must include at least one of the keywords from the afore-mentioned list. However, not all announcements containing those keywords are considered green announcements. Only those that match the definition of green announcements and satisfy the selection criteria are included. As highlighted earlier, they comprise of announcements of reduction of air, water or land emission/pollution; waste reduction or recycling activities; the use of efficient alternative energy sources; investing in or sponsoring of green programs; and the of signing of environmental agreements. Such announcements are viewed to be positive.

The daily stock price and index for all companies are collected from DataStream. The NZX All Index is used as a proxy for the market. The NZ All Index comprises all stocks listed on the New Zealand Stock Exchange Market. Although we search announcements from 1980 to 2012, all announcements effectively fall within 1998 to 2012. As a result, all the data are collected between 31st December 1996 and 8th August 2012. In order to avoid any confounding or spillover effects, we exclude from our data days that have multiple announcements on the same day. As such, only single positive news announcements have been included in the study.

MethodologyWe use a standard event study methodology (Brown and Warner, 1985 [33]). First, we take note of the date of green announcements by the companies and use a 61-day event window around the announcement day with 30 days before and after it. We then compute the average abnormal returns (AARs) and cumulative abnormal return (CAARs) relative to a 120-day estimation period prior to the event window and test their statistical significance. Day 0 is defined as the company’s official announcement day. If an announcement occurs after the end of a trading day or during the weekend or a public holiday, the next trading day is considered day 0.

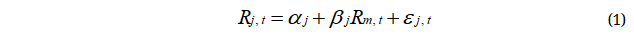

We consider the market model

where Rjt is the return of stock j at day t, αj is the constant term, βj is the slope which measures stock j’s sensitivity to a change in the market return, and εt is the error term on day t. The abnormal return of stock j on day t is defined as the difference between the actual and expected return:

where ARjt is the abnormal return of stock j on day t, Rjt is the actual return of stock j on day t, and  is the estimated return of stock j on day t. We compute the average abnormal return on day t as

is the estimated return of stock j on day t. We compute the average abnormal return on day t as

where AARjt is the average abnormal return of N stocks on day t, The cumulative average abnormal returns (CAAR) is then defined as

where CAARab is the cumulative average abnormal returns from day a to day b.

We use the following t-test to test the significance of the AAR.

where S is the estimated standard deviation of abnormal returns during the estimation period. To test for the significance of the CAAR over any period from day a to day b before, around, and after the announcement day, the following test statistic is employed.

where X is the number of days from day a to day b.

Tables 1 and 2 show the summary statistics of the event study and our sample data. The sample includes 30 green announcements made by nine companies from eight different industries. Table 3 shows the average abnormal returns (AAR) and cumulative average abnormal returns (CAAR) with their corresponding t-statistics. It also provides the number of positive and negative AARs on each day. The abnormal return on announcement date is small, and both AAR and CAAR are not statistically significant.

The results in Table 4 concur with those in Table 3 where we see there is no statistical significance of the CAARs over various days surrounding the announcement day. This finding is consistent with the expectation of Jacobs et al. (2010 [16]) that green announcements from companies with a higher environmental reputation have a smaller effect on the market. It should be noted, however, that the AAR and CAAR in our results around the immediate announcement days have a positive sign, which lend credence to shareholders’ positive view of green announcements. This is evidenced by the average announcement day return of 0.01%, two-day (−1, 0) CAAR of 0.16%, two-day (0, +1) CAAR of 0.15%, and three-day (−1, +1) CAAR of 0.29%.

These findings lend credence to the conclusion that green announcements by listed firms in New Zealand do not have a significant impact on stock returns around the announcement day even though they are observed to be positive. Such findings may appear to be counter-intuitive and are not consistent with those of Ramiah et al. (2016 [17]) who find that green policy announcements are associated with significant abnormal returns in the UK market. However, they can be explained. First, New Zealand companies, especially those that are listed on the main board, are largely seen to be green (Kumar & Khanna, 2009 [5]). Their shareholders and other investors expect these companies to embrace green practices. Hence, additional green announcements have a reduced impact on the market (Jacobs et al., 2010 [16]).

Second, the value of going green is not always realized by public investors (Videen, 2010 [29]). Many environmental initiatives have a long-term effect on cost savings but may not benefit the firm in the short term. Moreover, many investors in New Zealand believe that being green is a social responsibility of corporations, especially for those that are industry leaders. Besides, equity investors may be more concerned about announcements that have a more direct impact on the company’s financial health. Some green announcements may even escape notice when they are not highlighted by the media.

Third, some investors may view green announcements as a negative signal on the companies’ future cash flows. At times, green initiatives may increase a company’s potential costs and lead to a reduction in its future cash flows. This partially explains the decreasing cumulative abnormal returns over the event window. For example, the announcement by “Trustpower in asking households to fork out an extra $2 a week to help pay for a doubling in the size of its wind farm provides a clue for increasing billings. No doubt, wind is more sustainable and greener than traditional energy sources, but it is also more expensive than other forms of energy, at least at the current state of technology. However, two contrary perspectives may occur: those who are more price sensitive would consider moving their business to the competition that charge less; those that prefer greener energy sources are happy to pay more. It should be mentioned that most New Zealand companies are not able to achieve economies of scale compared to those in other developed countries such as the U.S.A. or Australia.

A final contributory reason for this paper’s findings is that New Zealand is well known as a country with a high degree of awareness of environmental and sustainability issues, as pointed out earlier. It has very strict resource consent and building code requirements that incorporate several green practices into legal requirements. There are also strict guidelines on the use of natural resources. As such, asset expansion programs of companies must have already met certain green practices or obtained the necessary government approvals before embarking on them. Thus, specific green announcements by a firm as defined in this article may lead to a reduced impact on its stock returns.

The purpose of this paper is to investigate the effect of corporate green announcements on the stock performance of listed companies in New Zealand, which is a small developed economy. We find that the market has a positive, though not significant, reaction to such announcements. We interpret this to mean that New Zealand companies are viewed to be already quite green at the onset. As such, the market is not very much surprised by such announcements and expect them to continue being green. The positive market reaction reinforces the corporate communication of such announcements. Our results are also consistent with the view of Engardio et al. (2007 [25]) that to be green is costly. This is especially so in a developed economy where the costs of doing business are rather high. We expect that green announcements in developing economies, which have much lower business costs, would have a more significant positive reaction among their shareholders. Nonetheless, managers are encouraged to continue their investments in green initiatives as the net impact of their announcements is still positive, though not statistically significant, over several days around the announcement day.

The findings of this study underscore the importance for corporate managers in New Zealand that, while any positive green announcements that they make might not have a significant market reaction, they are nonetheless positive. On the contrary, any green report that is negative would likely have a negative market reaction.

We acknowledge the data limitation of our study. It is recommended that future research should consider a larger sample that includes both positive and negative announcements when more of such information becomes available. It would also be nice to conduct a similar study on other countries, both developed and developing, that may be considered “green” to see if the conclusions are similar.

The dataset of the study is available from the authors upon reasonable request.

The author declares that there is no conflict of interest.

Research assistance by Bruce Chong is gratefully acknowledged.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

28.

29.

30.

Ding D. The Effect of Green Announcements on Stock Returns of New Zealand Listed Companies. J Sustain Res. 2020;2(4):e200037. https://doi.org/10.20900/jsr20200037

Copyright © 2020 Hapres Co., Ltd. Privacy Policy | Terms and Conditions